rsu tax rate us

This rate is 238 20 plus the 38 tax on net investment. Since RSUs amount to a form of compensation they become part of your taxable income and because RSU income is.

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

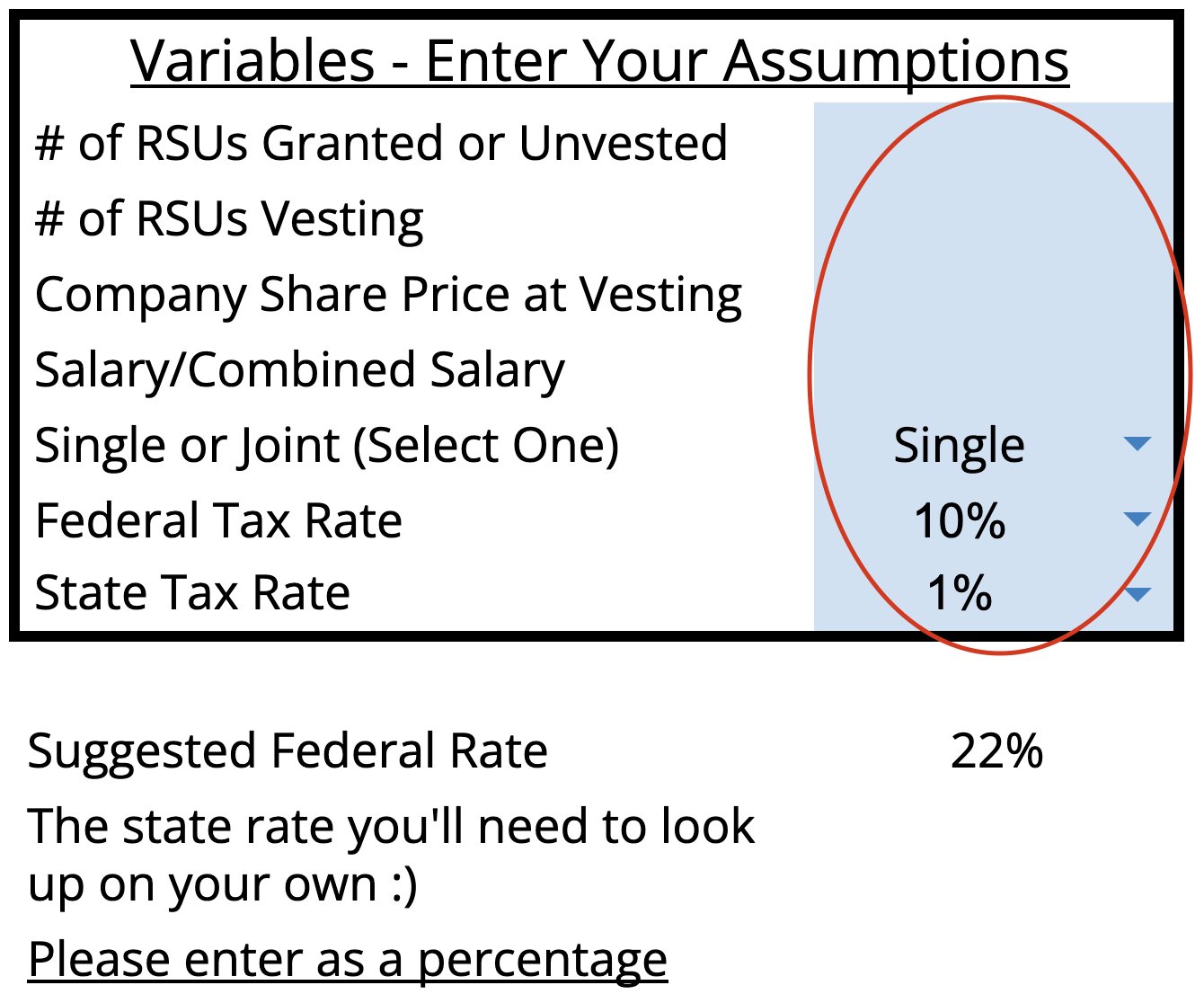

So its up to you to select a percentage from the dropdown.

. The page explains about taxation of Restricted Stock Units RSUs. Marginal Federal Tax Rate You. Restricted Stock Units RSUs Tax Calculator Apr 23 2019 Off Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy.

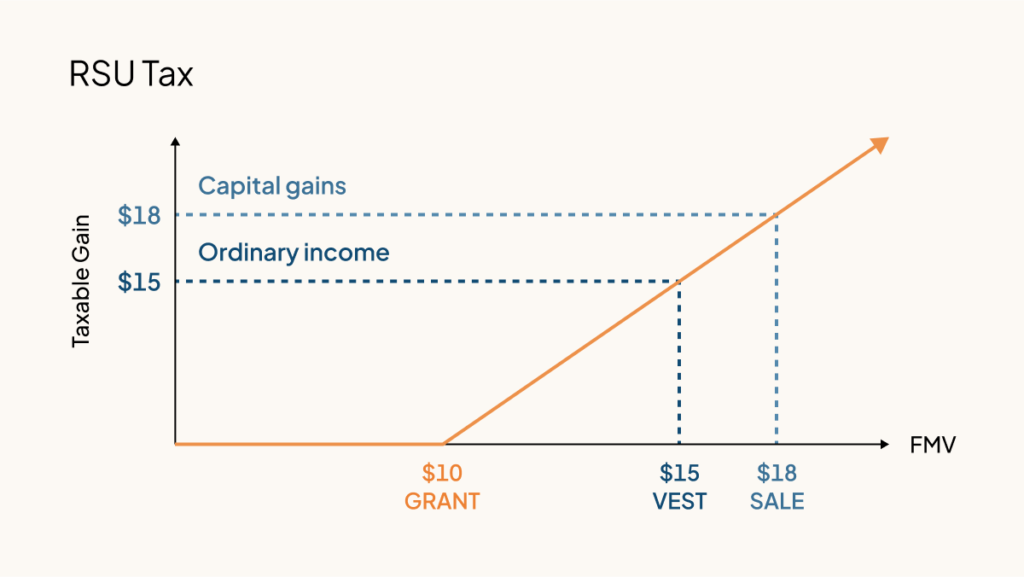

For one a recipient cannot sell or. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. Long-term capital gains tax on gain if held for 1 year past.

Vesting after making over 137700. His vast experience and understanding of. Vesting after Medicare Surtax max.

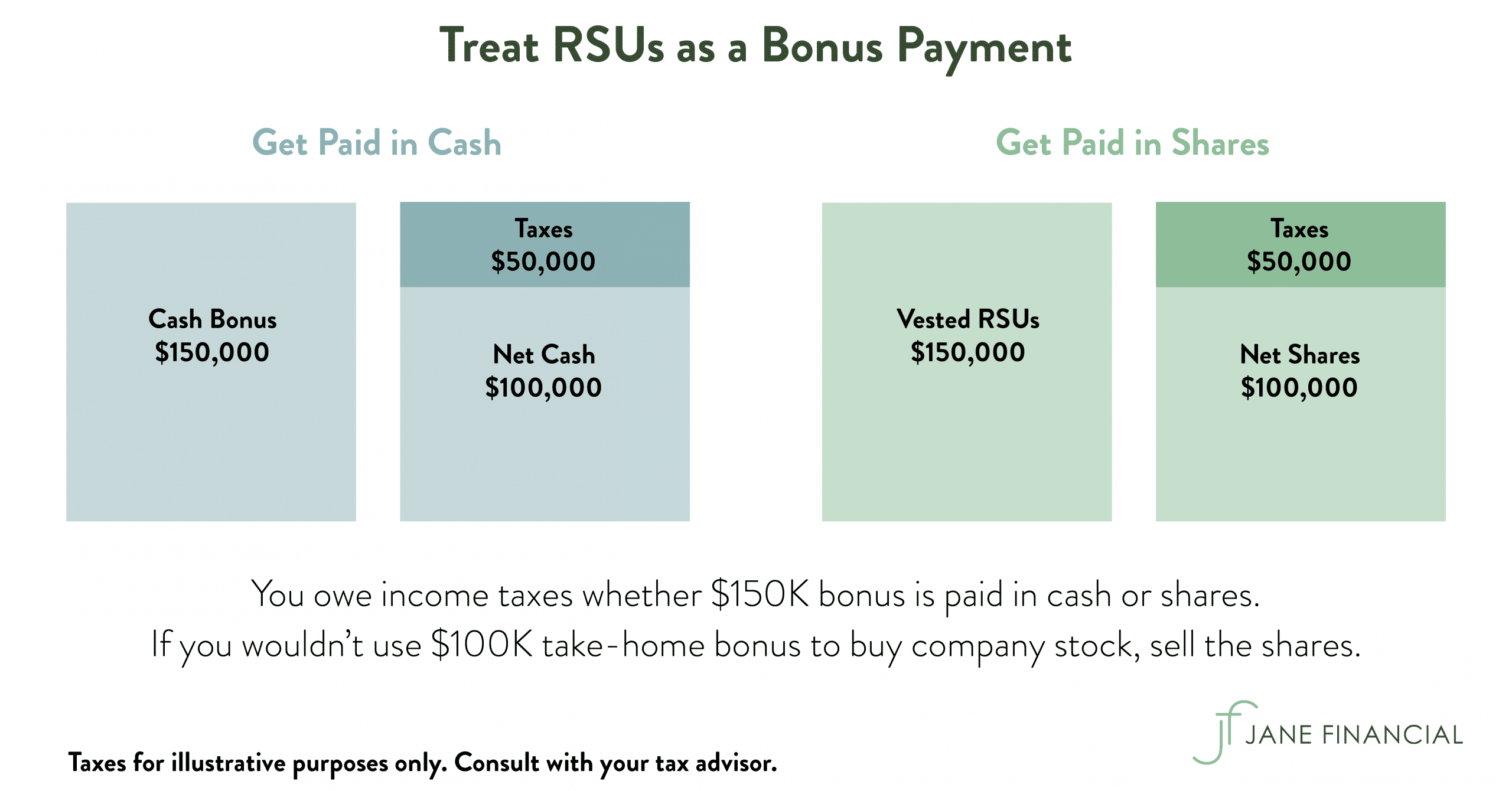

Restricted Stock Units better known as RSUs are an increasingly popular form of incentivisation offered to employees. Market value of shares. Taxes are usually withheld on income from RSUs.

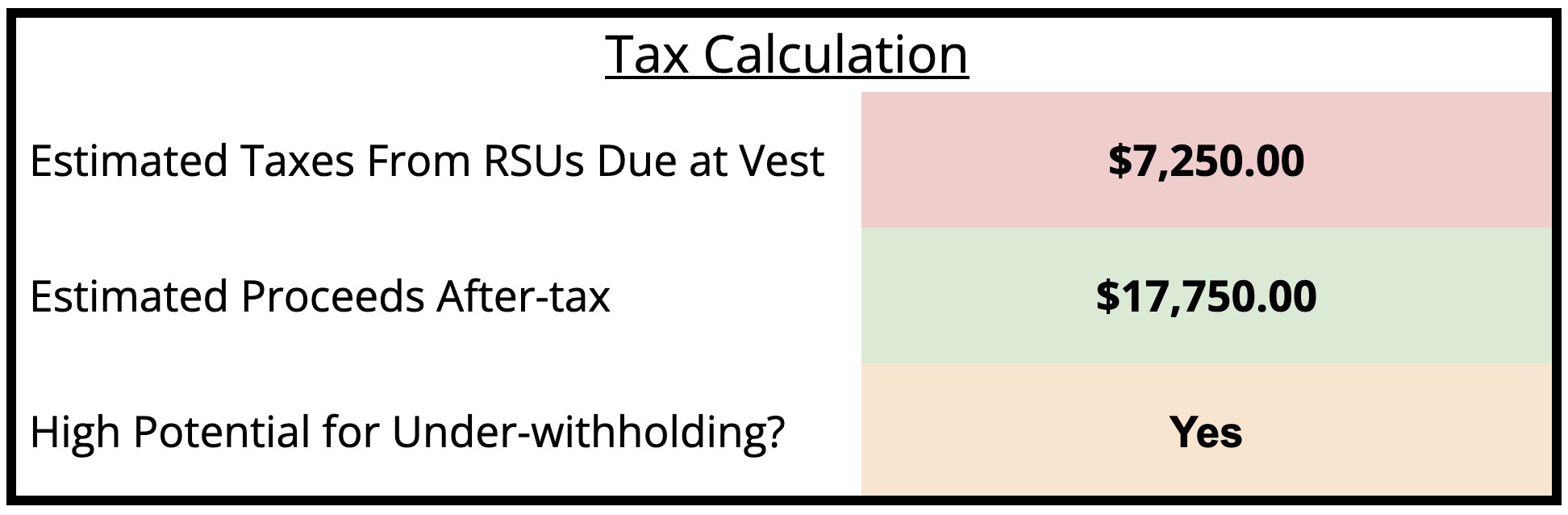

Heres the tax summary for RSUs. Claires tax on the RSU vest. If you live in a state where you need to pay state.

For your state tax rate itd be a little much for us to pull each states income tax and include it. His experience includes both Canadian and US income tax compliance payroll social tax compensation and tax policy consulting. 44 020 7309 3851.

Partner Tax t. If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance. Many employees receive restricted stock units RSUs as a part of their compensation particularly in the tech industry.

Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. Restricted stock is a stock typically given to an executive of a company. Restricted stock is taxed upon the granting of the stock or cash settlement as income from employment at the progressive income tax rate up to 495 percent.

Vesting after Social Security max. Ordinary tax on current share value. The stock is restricted because it is subject to certain conditions.

If you already earn in excess of this and the. RSUs are taxed at.

Rsu Taxes Explained 4 Tax Strategies For 2022

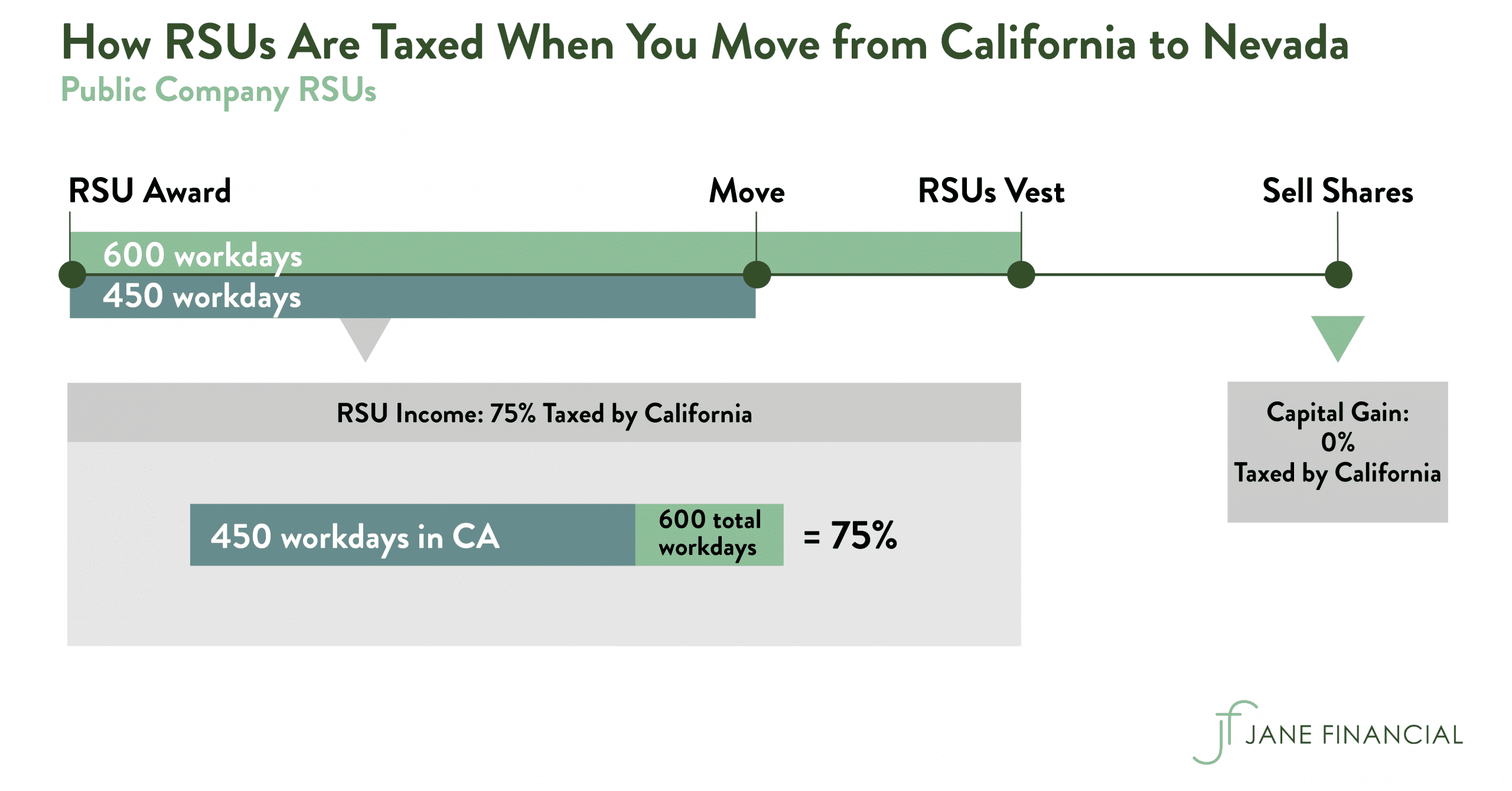

Restricted Stock Units Jane Financial

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

![]()

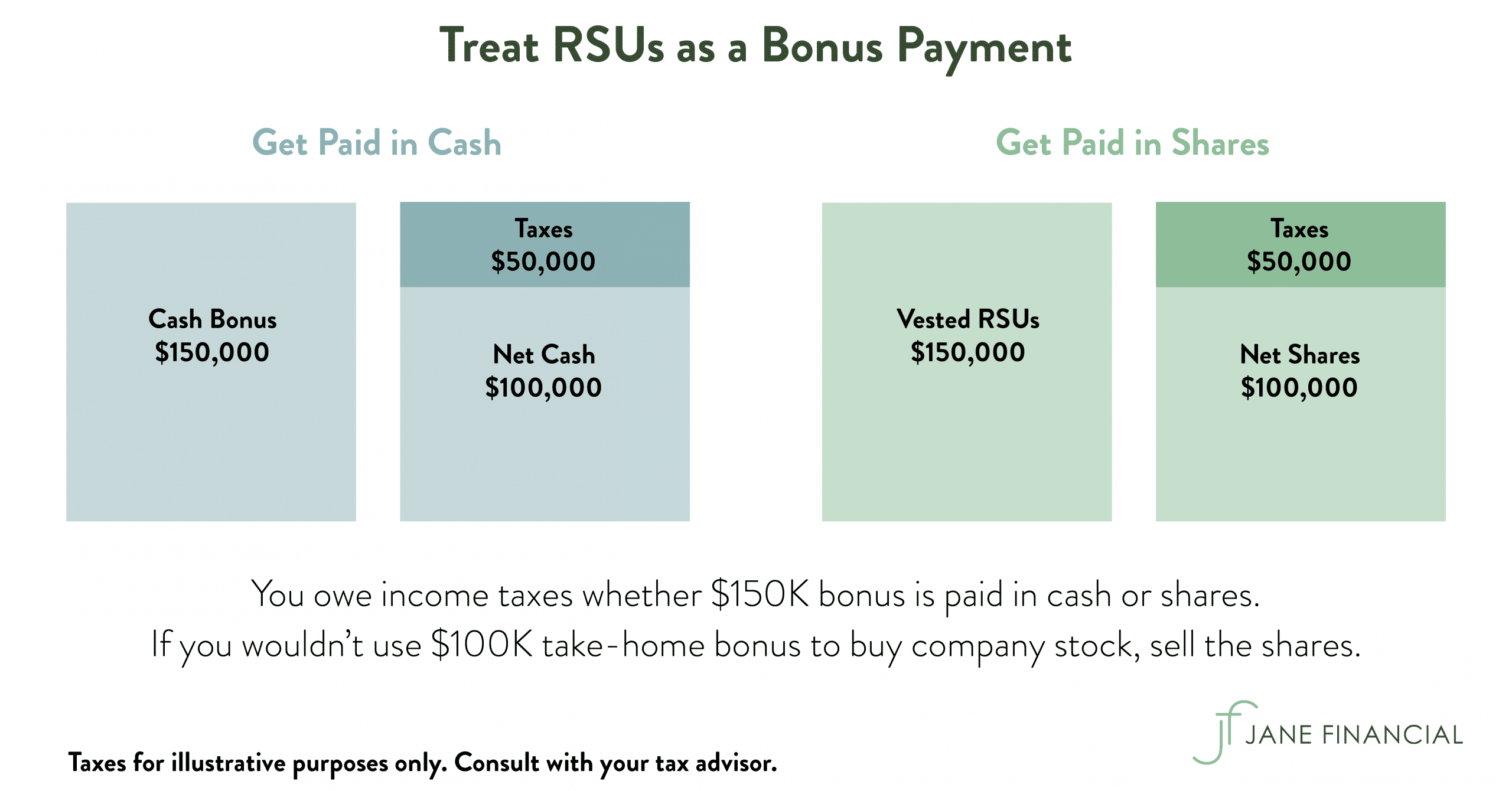

What The Heck Is An Rsu And What Do I Do With Mine And How Is It Different From A Bonus The Planning Center

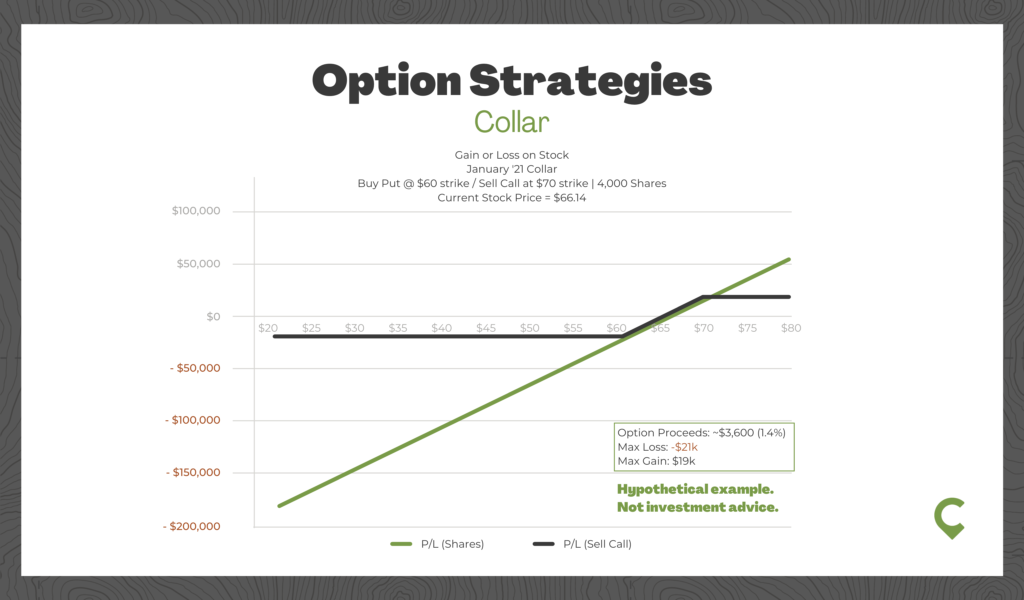

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

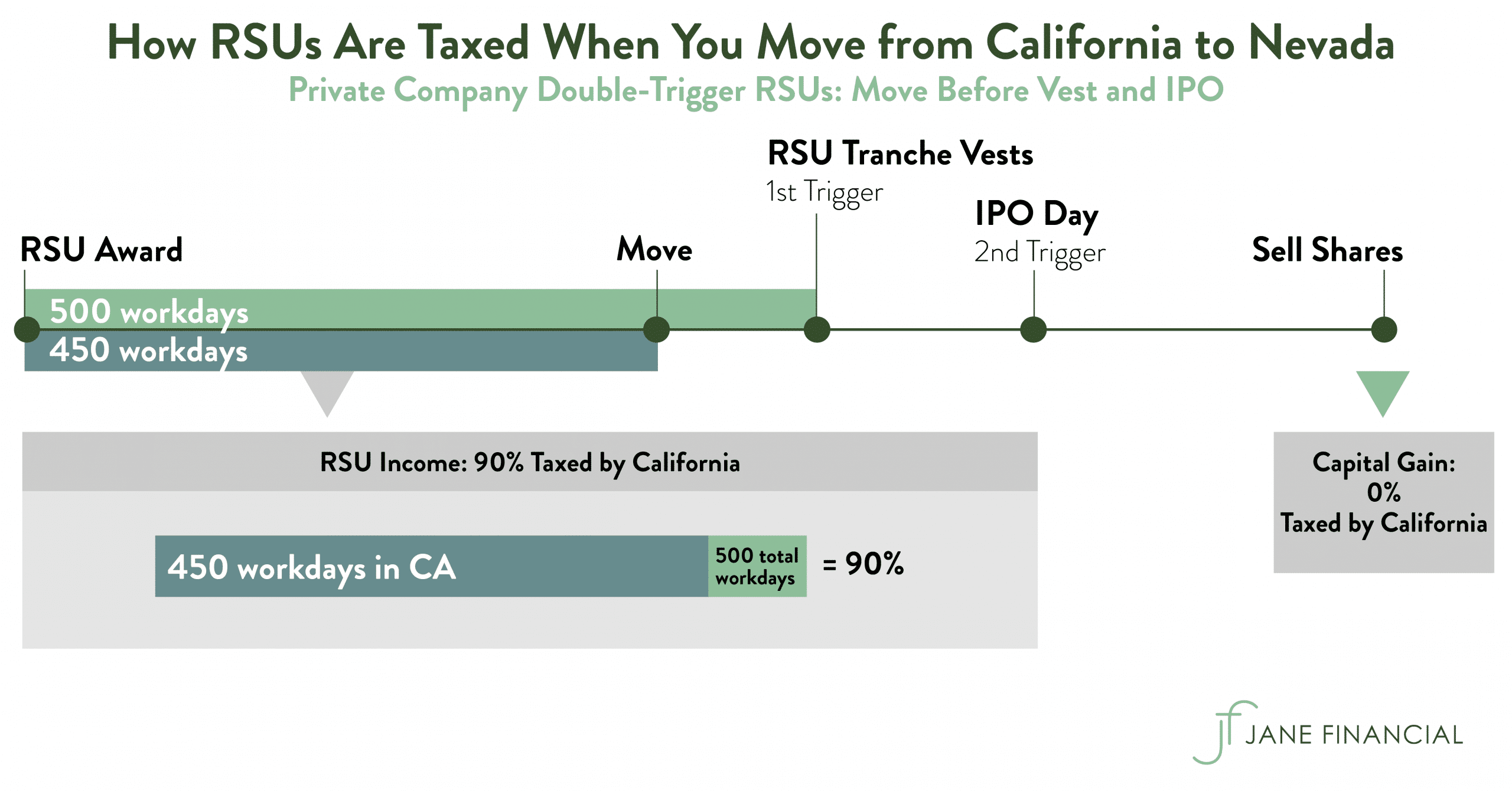

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Why Rsus Can Make Tax Season Painful

Rsu Taxes Explained 4 Tax Strategies For 2022

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsa Vs Rsu What S The Difference Carta